A senator looks at lowering Canada’s voting age, the average Canadian family pays 42.3% of income on tax, and a couple former MLAs join the Alberta Party. Also, several Quebec corporations sue the federal government over TFW changes.

Download Now

Direct Download – 64 Kbit MP3 (Full Show Notes)

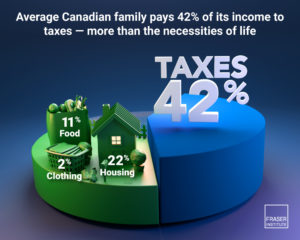

“At a time when the cost of living is top of mind across the country, taxes remain the largest household expense for Canadian families. While Canadians can decide for themselves whether or not they get good value for their tax dollars, they should understand how much they pay in taxes each year.” – Jake Fuss, director of fiscal studies at the Fraser Institute on the overall tax burden on Canadian families continuing to rise.

Duration: 1:01:03

Hosts: Shane and Patrick

- Lowering Canada’s voting age to 16 is her ‘top parliamentary priority,’ senator says

- Support us on Patreon

- Average Canadian family spent 42.3% of income on taxes in 2024: study

- Ex-UCP MLAs to join, rebrand Alberta Party instead of rebooting Progressive Conservatives from scratch

- 23 Quebec business owners launch $300 million lawsuit over temporary foreign worker permits

- Word of the Week: Suppression